ACE 2026 - The home of global charter.

The bimonthly news publication for aviation professionals.

The bimonthly news publication for aviation professionals.

For week 21, ending 28th May, global business jet activity is down by nine per cent compared to the same dates in May 2022, according to WingX's weekly Global Market Tracker. This widens the month-to-date decline of seven per cent versus May last year. For the year-to-date, the drop in global business jet activity is now five per cent compared to last year, but still up 17 per cent versus 2019. Comparably, global scheduled airline activity is trending 10 per cent up on last year so far this month, but still 14 per cent behind May 2019, although the top five global airlines have flown seven per cent more sectors this month compared to four years ago.

In week 21 business jet sectors fell eight per cent compared to the previous week and were 10 per cent behind the same dates in 2022. In the last four weeks activity fell eight per cent behind the same dates in 2022. 59 per cent of business jet flights in North America this month have been less than 90 minutes in duration, and flights of this length are down five per cent compared to last year but are 11 per cent ahead of 2019. Flights between one and a half to three hours have seen the largest increase since pre-pandemic May with flights up 28 per cent. Ultra-long-range flights of 12 hours or more have slumped the most compared to last May with flights down 31 per cent.

In the US business jet activity during the Memorial Day Weekend (26th – 29th May) was up 14 per cent compared to the same holiday weekend in 2019, but nine per cent down on the Memorial dates last year. In contrast scheduled airline activity was down nine per cent this year compared to the 2019 holiday weekend.

Demand across the top business jet operators in the US this month (1st – 28th May) was mixed, NetJets' US departures were down one per cent compared to last year, although 30 per cent ahead of activity in the comparable 2019. Flexjet has seen departures rise 10 per cent this month compared to last year, 96 per cent ahead of 2019.

In week 21, European business jet sectors grew 14 per cent compared to the previous week but fell 11 per cent behind the same dates in 2022. The trend in the last four weeks is 10 per cent below the same dates in 2022, but still seven per cent ahead of 2019. All the busiest European markets have seen business jet activity levels fall behind last year during May. The busiest market, France, has seen departures drop off eight per cent compared to last year, with double digit declines for the UK and Germany. Portugal has bucked the overall European trend with departures up 21 per cent compared to May 2022.

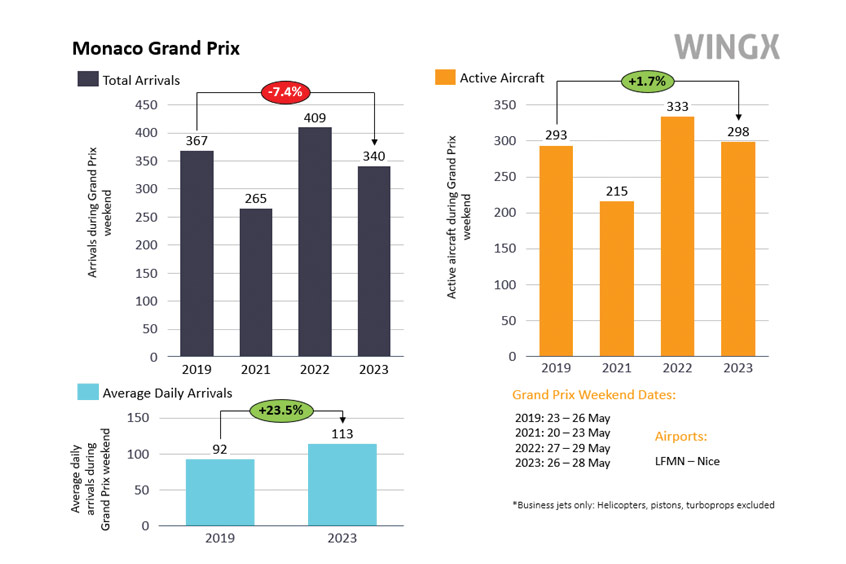

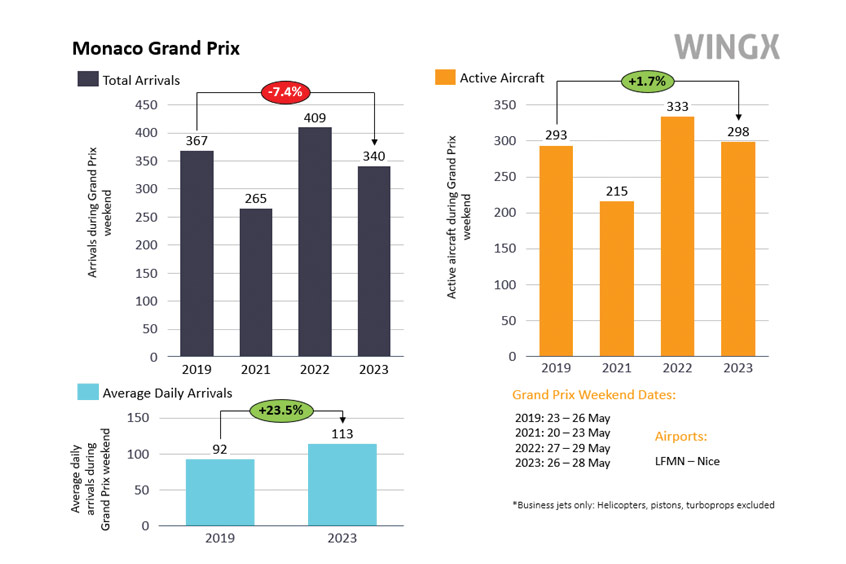

During the Monaco Grand Prix last weekend (26th – 28th May), business jet arrivals into Nice were down seven per cent compared to the 2019 Grand Prix dates, although the 2019 event was held over a longer four day period. In terms of average daily arrivals, the 2023 Grand Prix saw 24 per cent more business jet arrivals compared to four years ago. But compared to the 2022 event, the busiest on record, arrivals were down 17 per cent this year. Elsewhere in Europe's business jet calendar, there were 187 business jet arrivals into Geneva during the EBACE event days last week (23rd – 25th May), 10 per cent fewer than during the EBACE period in 2022.

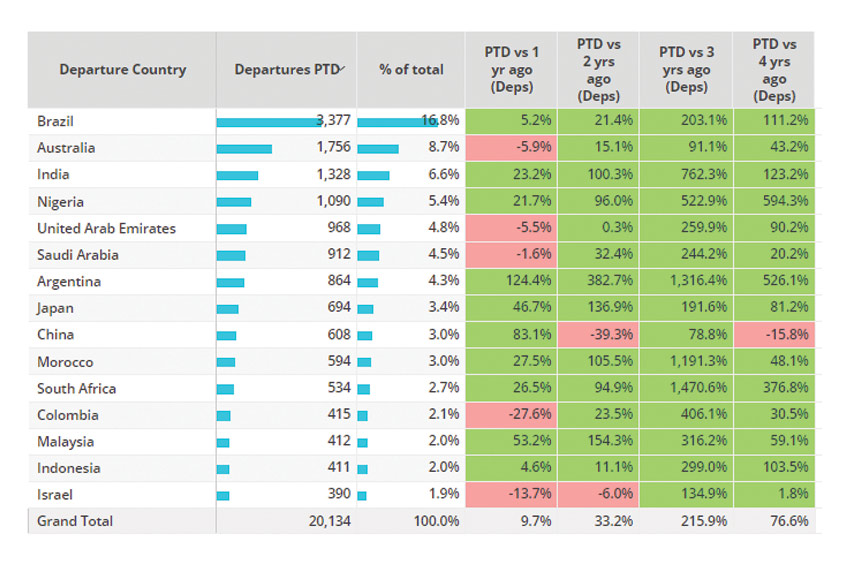

In the first 28 days of May, business jet departures outside of North America and Europe are trending 10 per cent ahead of last year. The busiest markets are seeing some declines compared to May last year, with Australia down six per cent, United Arab Emirates down six per cent and Saudi Arabia down two per cent. Business jet departures from China are down 16 per cent compared to May 2019, but rebounding 83 per cent compared to last year.

WingX managing director Richard Koe comments: “Business jet activity tapered significantly in the most recent week compared to the same week last year, although the lead on 2019 remains fairly robust. The market is weathering discouraging news [on the] charter market and negative optics on sustainability. Charter bookings for summer 2023 are reportedly strong but may suffer from a generally deteriorating macroeconomic environment.”