ACE 2026 - The home of global charter.

• International Aircraft Dealers Association (IADA)

BAN's World Gazetteer

• Texas The bimonthly news publication for aviation professionals.

The bimonthly news publication for aviation professionals.

While annual business jet resale volume was slightly higher for members of the International Aircraft Dealers Association (IADA) in 2022, aircraft dealers indicate that market conditions are normalising. In the recently released 2022 Fourth Quarter IADA Market Report, IADA accredited dealers and certified brokers reported 1,399 used aircraft sales transactions closed in 2022, compared to 1,370 in 2021. This represented a two per cent increase and the highest total for IADA members in recent memory.

For the year just ended, resale volume represented $9.3 billion in sales or an average of about $8 million per transaction. As expected, December was the busiest month of the year with 259 resales reported, easily doubling the year's monthly performance average and surpassing December 2021's 255 transactions.

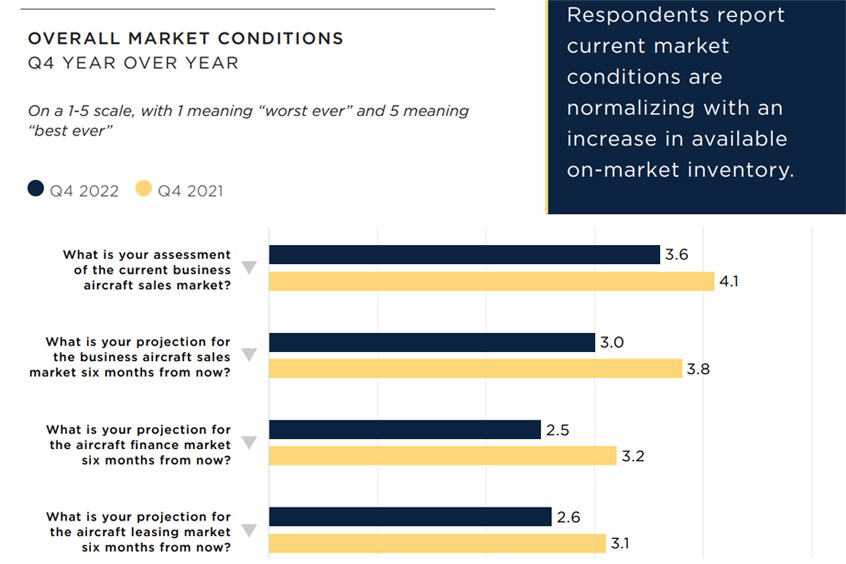

“Looking forward, IADA members have slightly more modest expectations than they did a year ago for the aircraft resale market over the next six months,” says IADA executive director Wayne Starling. “Based on our perspective survey of IADA members, the more moderate six month resale projections also hold true for the aircraft finance and aircraft leasing market.”

Atlanta, Georgia-based accredited dealer OGaraJets market research manager Austin Bass says: “Over the next six months, I believe we will continue to see market normalisation. I anticipate a more balanced market, with the majority of aircraft beginning to depreciate at slightly higher than pre-pandemic levels. Pricing for high-time and legacy aircraft will likely fall the most, while pricing for newly delivered aircraft will likely benefit from OEM backlogs.”

The perspectives and projections from IADA members for the IADA Market Report are informed by the monthly activity reports submitted by IADA dealers through AircraftExchange. In addition to sales data from AircraftExchange listings, the IADA Market Report includes data from all IADA accredited dealer activities and transactions, reported in total.

IADA members noted that the next six months should bring a slight increase in inventory and stable outlooks for supply, willingness to inventory and demand. This holds for all business aircraft segments, including turboprops, light jets, mid-size jets, and large and ultra-long range business jets.

Year-to-date, IADA members reported 688 new acquisition agreements in 2022, 723 exclusively retained to sell agreements, 104 lowered price transactions, 85 deals that fell apart and 972 aircraft under contract. Overall activity was similar to that of 2021, except there were more lowered price transactions in 2022 and fewer aircraft under contract.

“Market demand has greatly surpassed supply for the past two years, and while this is still the case, the market's extreme demand has recently settled likely on the heels of market pricing that elevated to all-time highs in the summer of 2022, resulting in supply and demand moving toward alignment,” says IADA vice chair Phil Winters, VP of sales and aircraft management/charter for Idaho-based Western Aircraft.

"Overall, the market seems very resilient and healthy for the time being. The demand side of the market (buyers) continues to do a good job, absorbing the increasing amount of inventory hitting the market. This continues to surprise me, although maybe it shouldn't anymore," says Texas-based Dallas Jet International senior partner Shawn Dinning.

"We continue to experience very strong client demand. Half of our transactions are on aircraft that never see the open market, and 100 per cent of those current off-market transactions include an IADA dealer/broker on the other side," says Colorado-based Wetzel Aviation owner and managing director Jim Riner.

OGaraJets president and CEO Johnny Foster says: "While inventories rose slightly over Q3/Q4, OGaraJets tracked four consecutive declining weeks in December. Our Q1 pipeline remains flush with a handful of 'left-over' 2022 transactions as well as several new listings and acquisition engagements. Today's market still very much favours the seller; however, we do expect to see a slow building of supply as we move into Q2 and summer, creating some softening in prices. That said, we do not predict a significant building of supply nor a significant dilution of prices."

The IADA Market Report is an informative and reliable view of the state of the aviation industry. It covers IADA-accredited dealers' perceptions about the market taken from its survey of IADA members and actual sales data reported monthly by IADA dealers, even when inventory is difficult to locate and might never appear on the open market. However, it does not include pre-owned aircraft transactions conducted solely by IADA's OEM members.