ACE 2026 - The home of global charter.

The bimonthly news publication for aviation professionals.

The bimonthly news publication for aviation professionals.

Twelve days into November and business jet and turboprop activity is on par with last year and 19 per cent ahead of 2019 according to WingX's weekly Global Market Tracker.

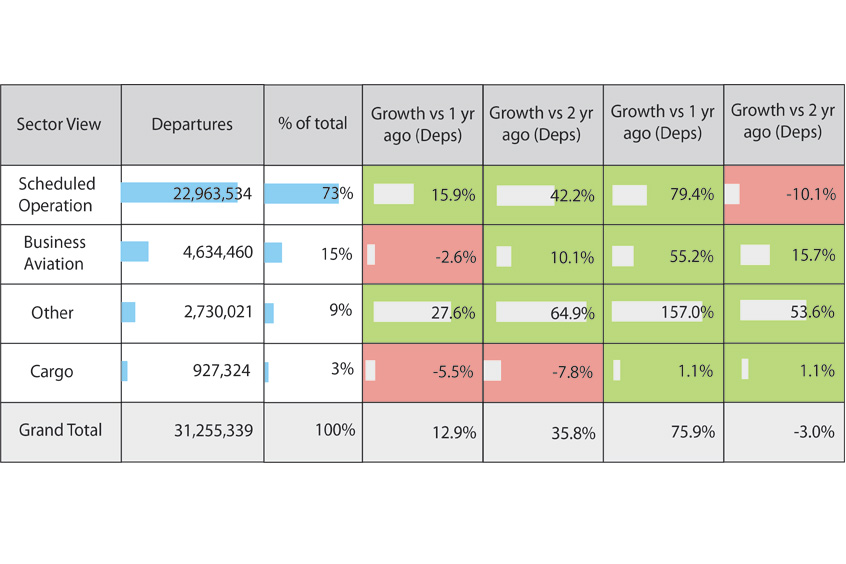

Business jet traffic is down one per cent compared to last November, but 19 per cent ahead of four years ago. So far this year business jet and turboprop activity is three per cent behind a comparable last year, but still 16 per cent ahead of four years ago. Focusing on just business jet flights, there have been 3,100,000 sectors flown globally so far this year, four per cent fewer than comparable last year and 19 per cent ahead of four years ago. Year-to-date scheduled airline sectors are 16 per cent ahead of last year, 10 per cent behind 2019. Year-to-date dedicated cargo sectors are six per cent behind 2022, one per cent ahead of 2019.

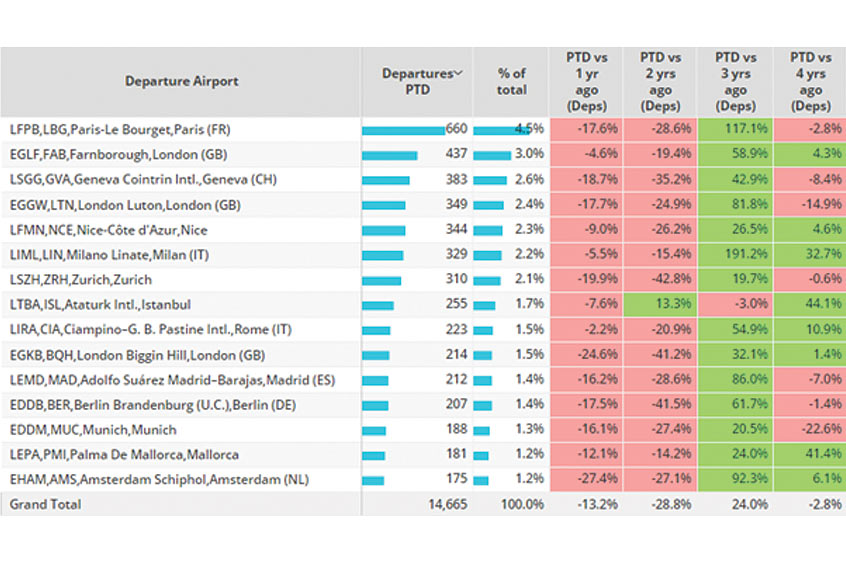

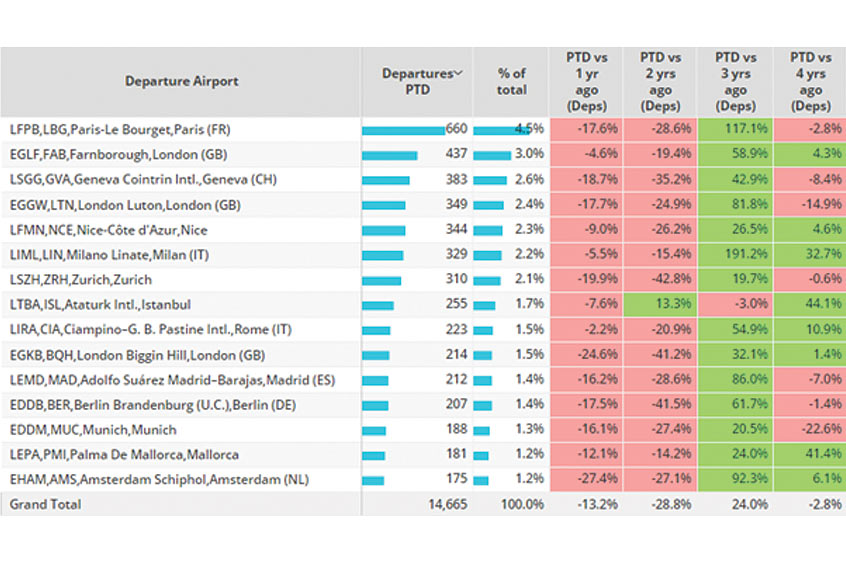

Twelve days into November, business jet activity in Europe is 13 per cent behind the same dates last year and three per cent behind a comparable 2019. All major business jet airports in Europe are seeing less activity this month compared to last year. Several airports are even behind November four years ago, namely Le Bourget, Geneva and London Luton.

61 per cent of business jet flights in Europe this month were under 90 minutes in length, with flights of this duration down 15 per cent compared to last year and six per cent below 2019. Long haul flights of between six to 12 hours are ahead of last year by six per cent, while ultra long haul flights of 12 hours or more are down 38 per cent compared to a comparable 2022, but 11 per cent ahead of 2019.

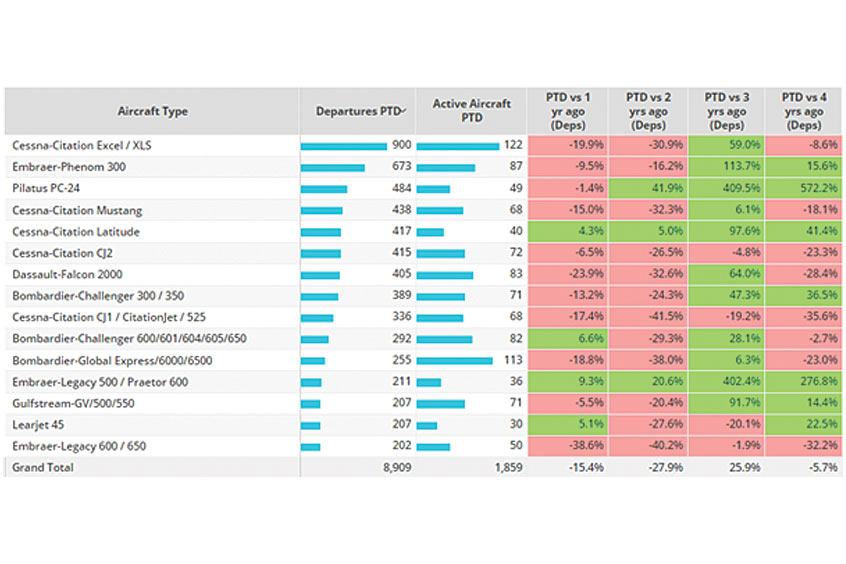

The Cessna Citation Excel has flown the most flights under one and a half hours across Europe this month, although 20 per cent fewer sectors than last year and nine per cent below 2019. This contrasts with the Citation Latitude, which is flying more flights under one and a half hours than any November in the last four years.

Week 45, ending 12 November , saw business jet activity in North America rebound six per cent compared to the previous week, three per cent ahead of the same dates in 2022. So far this month, activity across the region is on par with last year and 19 per cent ahead of 2019. Super midsize and ultra long-range jets are flying more than any comparable November in the last four years. Bizliner activity is stalling, remaining 21 per cent behind last year and 23 per cent down on pre-pandemic 2019.

Teterboro is the busiest departure point for super midsize aircraft types, with sectors up six per cent compared to last year and 14 per cent ahead of 2019. New York is the top metro area for super midsize aircraft, with sectors six per cent ahead, and hours nine per cent ahead, of last year. California-Nevada is the busiest super midsize cross state flow, with activity 50 per cent ahead of comparable last year.

In Asia the market is five per cent ahead of a comparable November last year and 50 per cent ahead of 2019. Aircraft management fleets are flying the most, with 1,576 flights so far this month, representing three per cent less than last year but 33 per cent more than 2019. Branded charter fleets are flying five per cent less than last year but are 46 per cent ahead of four years ago, while corporate flight departments are ahead of every November in the last four years.

In the Middle East, so far this month business jet activity is six per cent behind last year, although it is 47 per cent ahead of 2019. Top airport Al Maktoum International in Dubai is soaring ahead of comparable 2019 and four per cent ahead of last year. Elsewhere Doha International is seeing large gains compared to 2019 and is 20 per cent ahead of last year. Ninety nine departures this month from Ben Gurion International in Tel Aviv is 33 per cent less than last November.

Managing director Richard Koe comments: "Economic stagnation and geopolitical turbulence has stalled business jet usage in Europe and the Middle East. The powerhouse US market is holding up, lopsided towards large cabin aircraft demand."