ACE 2026 - The home of global charter.

The bimonthly news publication for aviation professionals.

The bimonthly news publication for aviation professionals.

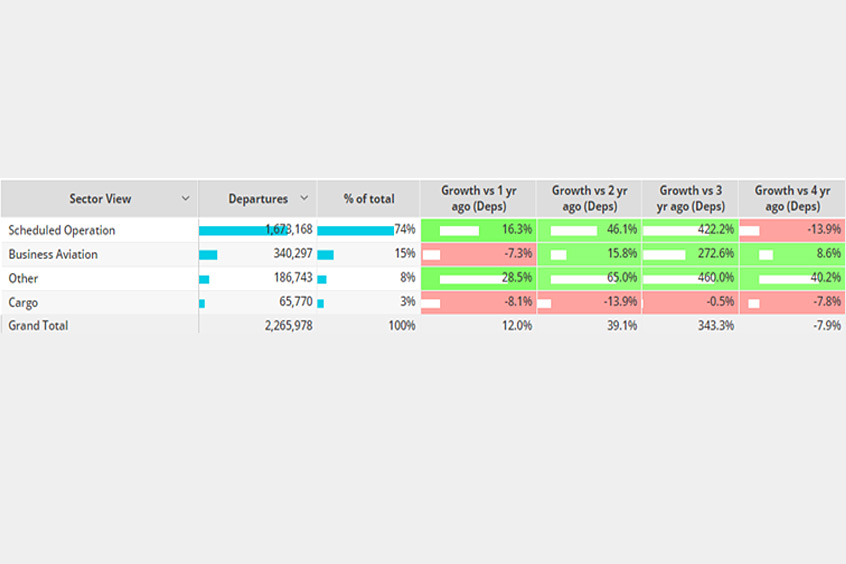

Global business jet activity fell two per cent in week 16 this year compared to week 15, six per cent less than the same dates in 2022 according to the WingX weekly Global Market Tracker. In the last four weeks activity is eight per cent below the same dates last year. So far this month, 1-24 April, business jet and turboprop sectors are seven per cent below last year, but nine per cent ahead of 2019. Over the same period scheduled airlines flew 1.6 million sectors, representing 16 per cent more than 2022, although this is still 14 per cent below 2019. Focussing on business jets, sectors are down nine per cent compared to last April, but 13 per cent ahead of 2019. So far this month the top five busiest global airlines are Southwest Airlines, American Airlines, Delta Airlines, Ryanair and United. Departures of these airlines are up 12 per cent compared to last year and five per cent above 2019.

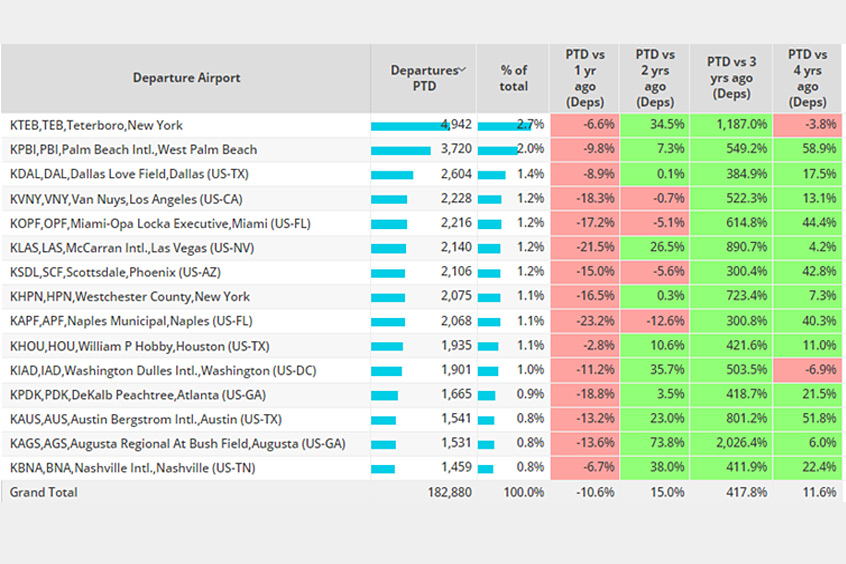

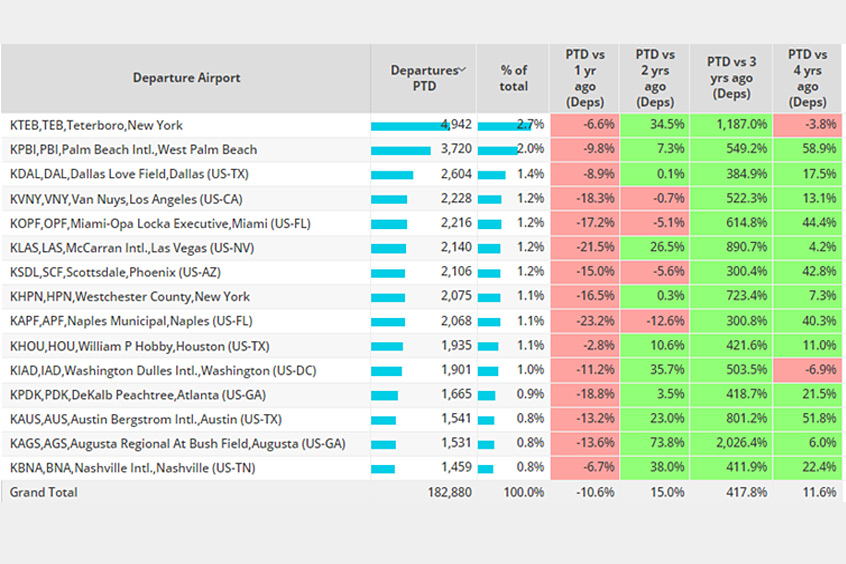

US business jet departures are down 11 per cent compared to last April, although still well ahead of 2019 with departures up 14 per cent. Mexico is the second busiest market this month, where departures are down seven per cent compared to last year and 37 per cent below 2019.

Light jets are the busiest aircraft segment this month, although departures are down nine per cent compared to last year but 13 per cent ahead of 2019. Heavy, midsize and entry level jets have seen activity in decline compared to 2019; very light jets are the only type to see growth compared to last year.

Trans-Atlantic (North America-Europe) business jet sectors have fallen one per cent compared with April 2022, although they are still 18 per cent ahead of 2019. Teterboro is the busiest departure point for transatlantic business jet flights, up two per cent compared to last month and 11 per cent ahead of 2019. US-UK is the busiest transatlantic country flow where flights are up seven per cent compared to last April and 32 per cent ahead of 2019. Elsewhere, flights between the US and France are down nine per cent compared to last year, Italy is up seven per cent and Ireland down eight per cent.

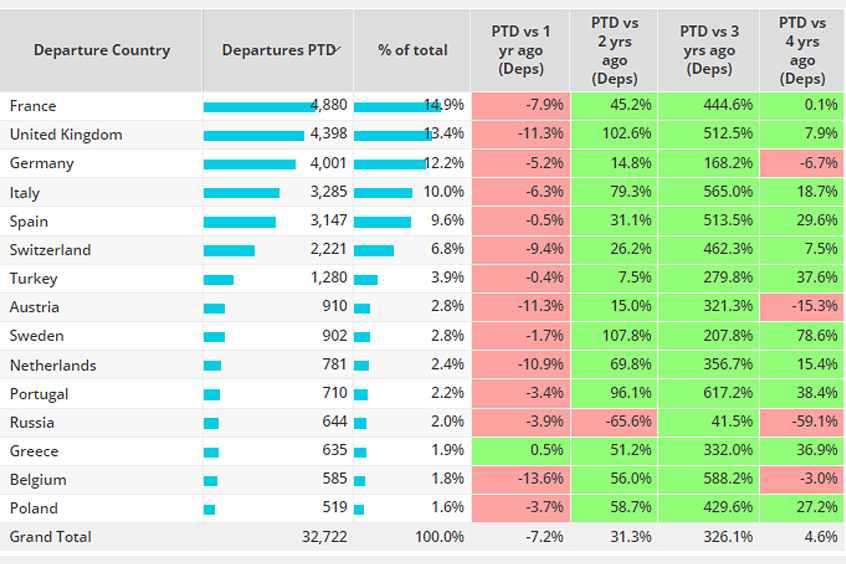

In week 16, European business jet sectors grew nine per cent compared to week 15 but are still two per cent below the same dates last year. In the last four weeks activity has fallen six per cent behind the same dates last year. Despite departures falling 11 per cent compared to last April, Paris Le Bourget is the busiest airport in the region where departures are up three per cent compared to 2019. Elsewhere departures from Nice are up three per cent compared to last year and are 12 per cent ahead of 2019. Geneva is seeing a 12 per cent drop compared to last year but Milan Linate up 20 per cent.

The only aircraft segments this month to see growth compared to last April are ultra-long range jets; flights of these aircraft types are up two per cent compared to last year and are up five per cent compared to 2019. Bizliners are still way behind pre-pandemic activity levels, with their sectors down 61 per cent compared to April 2019 and down 11 per cent compared to last year. Light jets are the busiest aircraft segment in Europe this month, although departures are down eight per cent compared to last year but eight per cent ahead of 2019.

In week 16, business jet departures in Africa were up 11 per cent compared to 2022, while in Asia and South America they rose nine per cent and 15 per cent respectively. In the Middle East departures were down six per cent.

Brazil remains the busiest rest of world market so far this month with departures up five per cent compared to last year and triple digit growth compared to 2019. Australia and India have seen sectors fall compared to last year, although they are still well ahead of 2019. Departures from the United Arab Emirates are up six per cent compared to April last year and 81 per cent ahead of 2019.

China is seeing triple digit growth in business jet departures compared to last year, although activity remains five per cent behind 2019. The Global 6000 series is the busiest type this month in the country; its departures are up 260 per cent compared to last April and 43 per cent ahead of 2019. Other types seeing triple digit growth compared to last year are the Gulfstream G600/650, Challenger 800/850, Falcon 8X and the Gulfstream G400/450.

WingX managing director Richard Koe says: “With the gap closing between commercial airline activity in 2023 and 2019, business aviation trends are moving in the other direction, with a just under 10 per cent gain in April 2023 versus April 2019. In the US, fractional operators are still hitting record levels of activity. In Europe, business jet flights out of Germany and Austria are now trending well below 2019 levels, and activity in France is now flat compared to four years ago. Other countries inside and outside Europe, including Spain, Italy, Turkey, UAE, and Israel, are still seeing strong gains in business jet activity compared to 2019.”