ACE 2026 - The home of global charter.

The bimonthly news publication for aviation professionals.

The bimonthly news publication for aviation professionals.

President Trump’s Big Beautiful Bill is finally enshrined in US law, but what effect has this had on the US business aviation market?

The 2025 tax and spending package reinstates the 100% bonus depreciation, on a permanent basis, for aircraft acquired after 19 January, 2025 (and potentially for those delivered after that date if bought before). It means that for accounting purposes, the full value could be written off in year one, rather than spread across multiple years and never fully written off. A $5 million aircraft could be a $5 million deduction in its year of purchase.

2017 saw an increase in business aircraft acquisition when pre-owned aircraft were added to the fully 100% expensing provisions (bonus depreciation) of the Tax Cuts and Jobs Act. During the pandemic, transaction activity stayed steady as business flying was down significantly, but more personal use owners came into the market for reasons of safety and security. Although 100% bonus depreciation was still available, it was not driving transactions during that period.

Bonus depreciation rates began to be phased down in 2023 and were set to permanently expire by 2027, but various industry groups lobbied for full expensing to be reinstated.

Glenn Hediger, president and founder of Aviation Financial Consulting, has been working daily with clients who have existing purchase agreements or who are looking to buy now with the added tax incentives. “Interest is very high, but with no sun-setting in the law, the urgency to find a deal before year end is not what it has been in previous years,” he says. He also notes that it isn’t just a matter of qualifying for 100% bonus, it’s whether the benefits can be utilised and monetised. The tax code is full of provision to limit this benefit.

“We’ve seen a lot of excitement and activity in the aircraft transaction market since the proposals started coming out earlier in the year,” he continues. “Now, with the 2025 Act, there is a marketing boom happening throughout the industry by manufacturers, resellers and brokers.” Now that the tax benefit is permanent, it will be interesting to see whether there is a spike in transactions or a steady increase over time.

Some of his buyers are acquiring whole aircraft for their personal use, leasing the majority of its capacity to a charter company. But in this scenario, enjoying the tax benefits is even more complex.

“Permanent 100% bonus depreciation for a new company aircraft is a huge cost benefit when accessing remote locations across the country,” he adds. “A wild card in that is how US trade policy develops in the next six to 12 months, and how the global economy responds.”

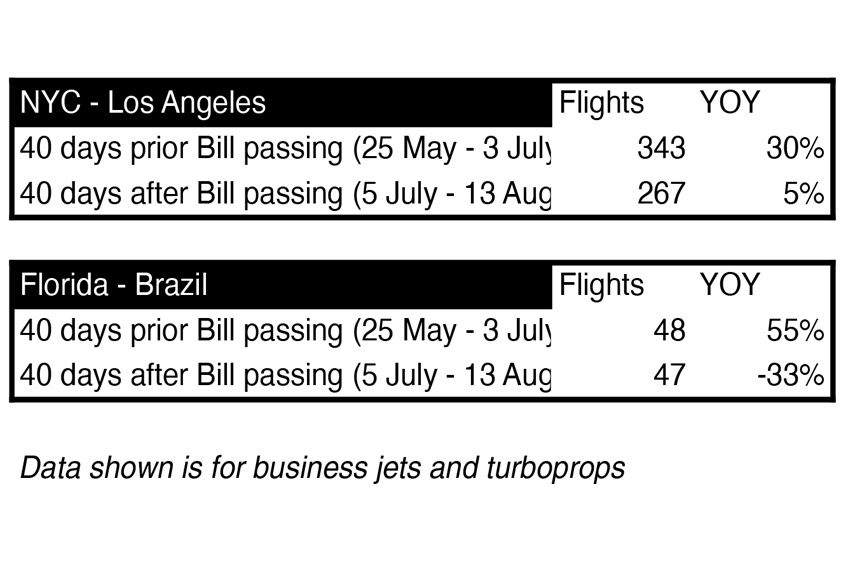

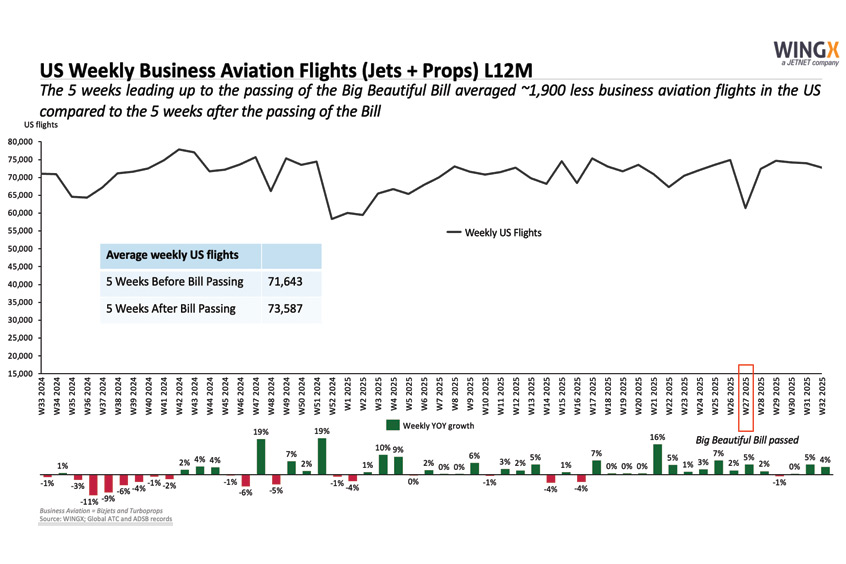

WingX data has shown no discernible impact on US business aviation activity since the Bill was passed on 4 July, just relatively normal seasonal activity trends, although US activity is actually up two per cent year on year. Its charts, pictured HERE, show flight numbers between New York to Los Angeles, and from Florida to Brazil, on the 40 days before and after the signing along with the year on year difference. In the five weeks prior, there were around 1,900 fewer business aviation flights in the US compared to the five weeks after.

According to the data intelligence consultancy, the immediate impact from the Big Beautiful Bill will be on aircraft transactions, and this tailwind could be offset by the tariff headwind. If the net impact of the Bill is positive, then new owners may enter the market and this should eventually add activity throughout the year, but it may take some time to see this come through.