ACE 2026 - The home of global charter.

The bimonthly news publication for aviation professionals.

The bimonthly news publication for aviation professionals.

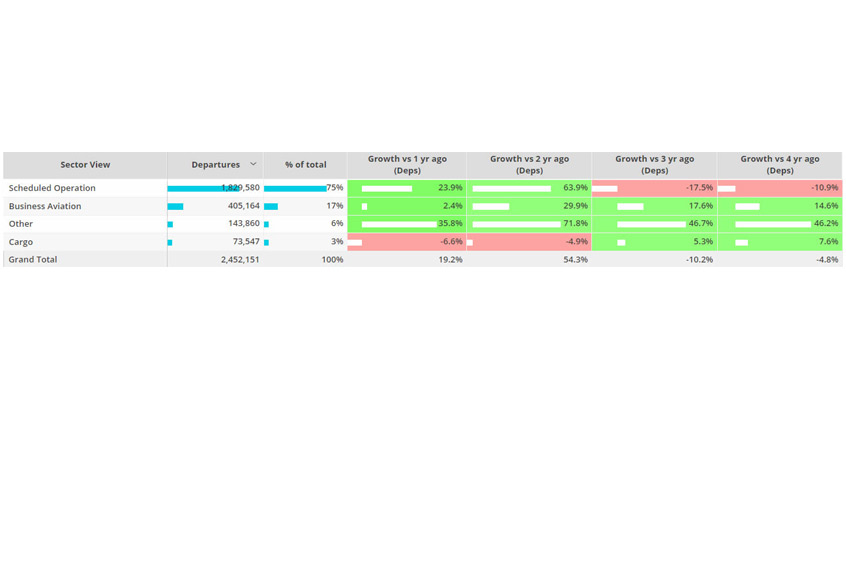

Thirty days into January and business jet and turboprop sectors were two per cent ahead of comparable 2022 and 15 per cent ahead of 2019, according to WingX's weekly Global Market Tracker. Turboprop sectors over the same period are six per cent ahead of last year and 10 per cent ahead of 2019. Business jet sectors are seeing slower growth, one per cent more than January last year and 17 per cent more than in January 2019. Looking back at the last three months (30 October 2023-30 January 2023) business jet sectors have fallen two per cent compared to the same period last year, but are still 18 per cent above three years ago. In the last 30 days scheduled airline sectors are 24 per cent above the same period last year, but down 11 per cent compared to January 2019.

30 days into January and business jet flights in Europe are down seven per cent compared to the same period last year, but six per cent ahead of January 2019. The erosion of business jet activity in Russia is contributing significantly to the overall trend; excluding Russia business jet demand is down three per cent compared to last year but nine per cent ahead of 2019. 65 per cent of business jet flights this month have been under 90 minutes in length; flights of this duration are down by one per cent and seven per cent above the same period in 2019. Short haul flights of between 1.5-three hours are down 15 per cent compared to last year and seven per cent more than 2019. Ultra-long haul flights of over 12 hours are up 56 per cent compared to January last year, a triple digit growth compared to 2019.

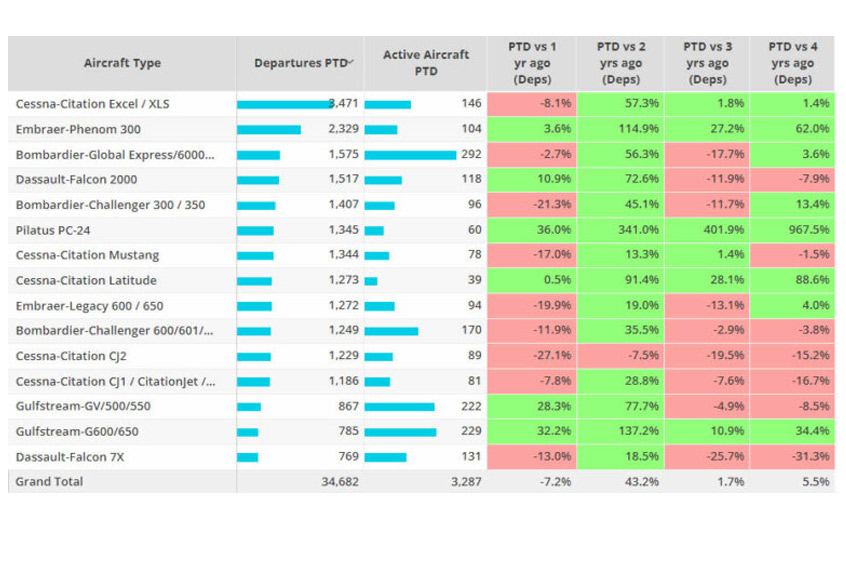

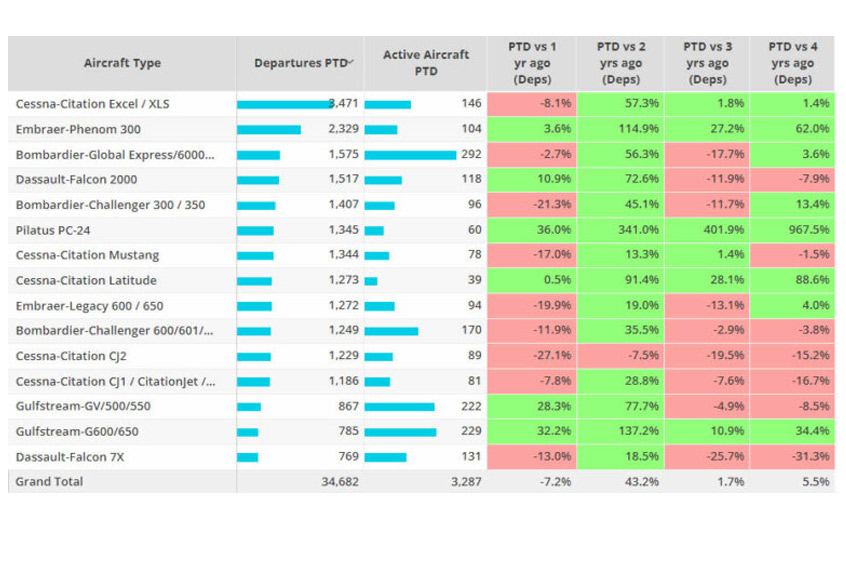

Business jet activity across the top markets is mixed this month, with France ranking as the busiest market, although sectors are down three per cent compared to last year. Activity in the UK is on par with last year, while in Germany it is slightly down. Spain is seeing an 11 per cent decline compared to January 2022, and departures out of Russia are 74 per cent below January last year. The Cessna Citation Excel/ XLS is the busiest business jet model so far this month, although its flights are down eight per cent compared to last year. Long range jets, however, have been more active this month compared to 2019. While the Bombardier Global Express/6000 series has been the most active aircraft model this month, up more than four per cent compared to 2019, there have been 34 per cent more Gulfstream G600/650 aircraft active than in 2019.

214,000 business jet sectors flew out of airports in North America between 1-30 January, which is on a par with last year but 15 per cent ahead of 2019. Flight hours for the same period are one per cent behind last year and 17 per cent ahead of January 2019. As January draws to a close, private flight departments have flown eight per cent more sectors than January last year and 21 per cent more than in 2019. Aircraft management programmes are flying five per cent less than last year, although they are 11 per cent ahead of 2019. Branded charter declines have picked up; sectors between 1-30 January this year are 18 per cent below a comparable January last year, but 13 per cent ahead of 2019. Teterboro is the busiest departure airport for branded charter flights in North America so far this month, followed by Van Nuys. Light jets are the busiest in the branded charter fleets this month, with flights down 15 per cent compared to last year but 24 per cent above 2019. The Cessna Citation Excel /XLS is the busiest branded charter aircraft type so far this month, although its flights are down four per cent compared to January 2019. Van Nuys-Las Vegas McCarran is the busiest branded charter airport pair, but its flights are down 15 per cent compared to last year.

Over half of all branded charter flights in North America this month have been under 90 minutes in length; sectors of this length are down 15 per cent compared to last year but nine per cent above 2019. Long haul flights of six-12 hours in duration are up two per cent compared to last year and 18 per cent above 2019. So far this month there have been almost 200 transatlantic branded charter business jet sectors between North America and Europe, which is eight per cent more than last year but 57 per cent more than 2019. As January draws to a close, Florida remains the busiest state, although departures from there are down six per cent compared to last year. Demand across other top states is mixed, with Texas up two per cent, California down four per cent and Colorado down 12 per cent compared to last year.

Outside of North America and Europe, business jet activity is trending 31 per cent above comparable January 2022 and 85 per cent above 2019. Brazil is the busiest rest-of-the-world market for business jets; while its sectors are up 20 per cent compared to last year, India is up by triple figures compared to last year and Australia up 22 per cent. Activity out of China is up 29 per cent compared to last year; almost 80 per cent of business jet flights in China are domestic but international flights are seeing triple digit growth compared to last year and versus 2021 but are still down 39 per cent compared to 2019.

WingX managing director Richard Koe says: “The downwards drift in business jet demand in Europe is starting to get concerning, with the charter market seeing the biggest drops, especially in central Europe. Conversely, transatlantic jet traffic is still well up. In North America, activity trends are mixed, with light jet charter falling back. In China, business jet activity is rebounding post covid, but is still behind 2019."