ACE 2026 - The home of global charter.

The bimonthly news publication for aviation professionals.

The bimonthly news publication for aviation professionals.

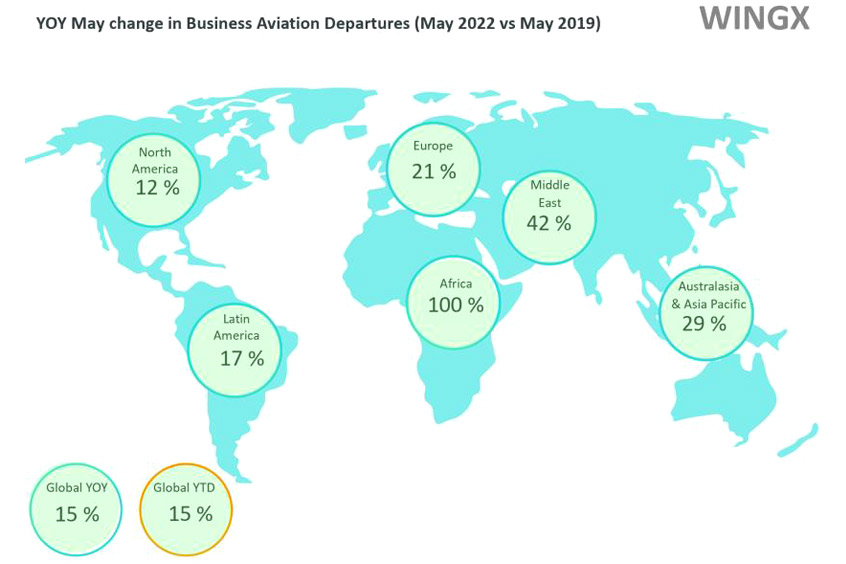

Latin America has seen a strong recovery in business jet traffic in 2022: almost 30,000 flight sectors operated so far this year, trending up by 34 per cent compared to the first half of 2021, and almost double the activity of comparable pre-pandemic 2019. Including turboprops, the South American region, excluding Mexico, saw 17 per cent growth in sectors flown in May 2022 compared to May 2019. WingX Advance managing director Richard Koe points out that this is quite a recovery from a low point in April 2020 when there were just 776 sectors operated, a 68 per cent drop in year-on-year activity.

The rebound in business aviation demand started in 2021 as the worst of the pandemic went by. Lockdowns were variable across the region but generally more stringent than in Europe and the US. Travel restrictions, particularly on scheduled airlines, have boosted demand for business jet services in the region.

This recovery in demand is being reflected in strong sentiment towards new aircraft acquisitions. According to Honeywell’s global survey in October 2021, purchase plans for new aircraft had by then recovered pre-pandemic demand. Whereas purchase plans in North America trod water last year, with surveyed operators expecting 13 per cent of the fleet to be replaced in the next five years, operators in Latin America projected a comparable appetite for 21 per cent fleet renewal. The relatively bullish outlook in Latin America implies the region will increase its share of the global demand for business jets from three to five per cent during the next five years.

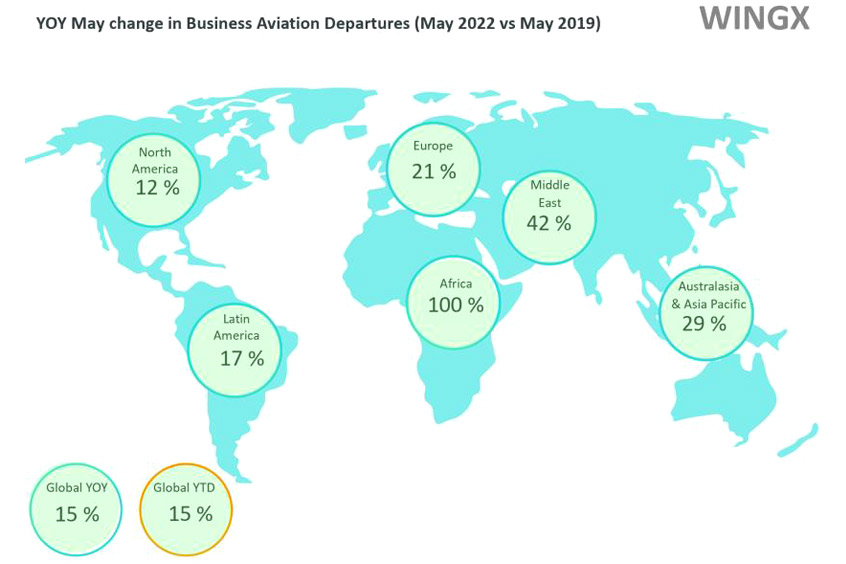

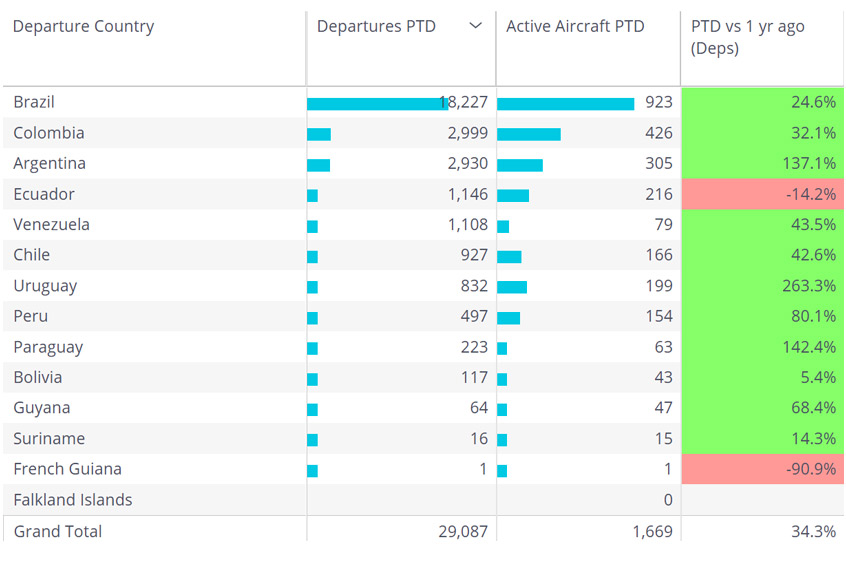

So far in 2022, and across the region, the substantial majority of business jet flight activity is originating in Brazil: 18,227 takeoffs recorded in January through May 2022. Brazil’s installed fleet of business aviation aircraft ranks it in the top five countries worldwide, but activity is much lower than for a comparable fleet in France for example, where over 40,000 business jet flights have been operated so far this year. Recorded flight activity in Brazil has captured 923 unique business jets, although many of these are transient rather than based in country. For example, 167 business jets have been active this year on flights between Brazil and the US. This international connection is up by 200 per cent compared to last year but still down 37 per cent compared to the first half of 2019. Domestic business jet travel in Brazil is up 100 per cent compared to three years ago.

Other South American countries with relatively large activity footprints include Colombia, Argentina, Ecuador and Venezuela. Apart from Ecuador, all these countries have seen substantial recovery in business jet demand versus last year. Business jet arrivals into Uruguay have rocketed up as restrictions have dropped and the tourists come back to fashionable resorts like Punta del Este. At the metro level, Brazil dominates, with four of the busiest five cities for business jet departures: Sao Paolo, Rio de Janeiro, Belo Horizonte and Brasilia, although Argentina’s capital city has seen a surge in business jet arrivals activity up 200 per cent compared to the first half of 2019. The busiest connection this year is between Sao Paolo and Rio de Janeiro, whereas the fastest growing connections are between Rio, Buenos Aires and Punta del Este.

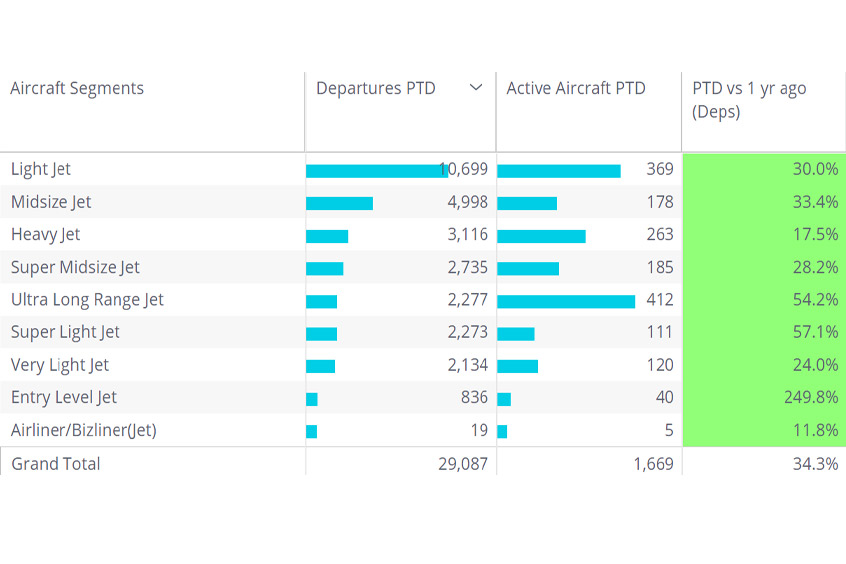

In terms of equipment being flown, the region has a preponderance of light jets flying one third of the activity so far this year, trending up by 30 per cent on last year. As the regional home of Embraer, it is no surprise to see the Phenom 300 as the busiest aircraft type, with just under 5,000 missions flown this year, 51 per cent more than in Jan-June 2019. The Phenom 100 is also a busy platform, although numbers are falling off this year compared to last. The Citation M2 and Learjets 45 and 60 are very popular. The PC-12 is well suited to the operating environment, and the PC-24 is also getting a foothold. The busiest midsize and large cabin jets are older platforms like the Hawker 700-900. Ultra long range jets have seen an upward trend in the region, with activity up 54 per cent this year.

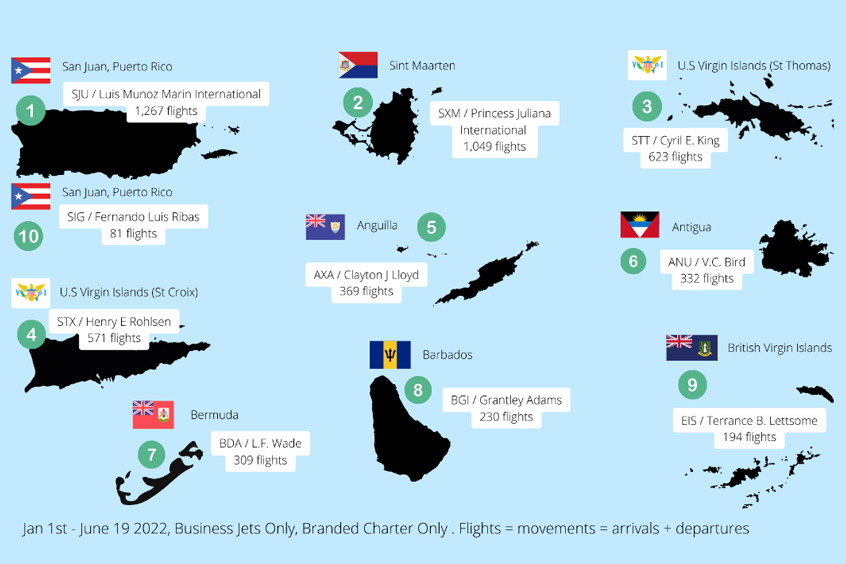

In Central America, the only substantial market for flight activity is Panama; its role as an offshore haven has attracted almost 1,000 business jet arrivals so far this year, up by 30 per cent compared to 2019. Nicaragua and El Salvador get a limited number of business jet flights, mostly connections with the United States. The Caribbean is a much busier region with 37,842 business jet sectors flown so far this year, an increase of 30 per cent on last year and up by 21 per cent compared to 2019. An additional 29,000 turboprop flights have been operated in the region, an increase of 14 per cent versus 2019.

The diverse pattern in business jet activity in the Caribbean reflects the mixed pattern of travel restrictions during the pandemic. The Cayman Islands and Barbados haven’t seen a full recovery of 2019 business jet arrivals. Puerto Rico, which completely lifted restrictions on inbound US tourists in April this year, is seeing a 25 per cent lift on last year’s business jet arrivals, fully 54 per cent above comparable 2019. The Bahamas, Costa Rica and Virgin Islands are seeing at least 40 per cent higher activity than in 2019. Turks and Caicos saw an early and significant rebound in business jet activity in 2021, 89 per cent higher than in 2019, and the islands are on track for another record year in 2022, with over 2,600 business jet arrivals through June.

In terms of Caribbean business jet arrivals, Lynden Pindling is the busiest this year, with 7,500 arrivals to date, a 26 per cent growth on comparable 2019. Of the other busiest airports, Cyril King in the US Virgin islands, Juan Santamaria in Costa Rica and San Juan in Puerto Rico have all seen more than 60 per cent growth compared to the first half of 2019. Many of the connections are with the the US, with Nassau’s links to Miami, Fort Lauderdale and New York being the key metro routes. Beyond intra-Caribbean and US connections, the busiest international links are with Canada, UK and Brazil, with Barbados being the top spot for these arrivals.

While the recovery in business aviation activity in South America is complete, and indeed some way above the 2019 benchmark, the region’s economic outlook does not favour as robust a growth rate in the second half of this year. The tailwinds are still there, with many pandemic restrictions still to be fully lifted. Airline capacity, crippled during the pandemic, will not fully restabilise until 2024. That will sustain demand for the business jet’s convenience. But it will do so in the face of increasingly turbulent macroeconomic headwinds. South America's economies are particularly vulnerable to inflation and associated interest rate growth. As time goes on, political instability and deteriorating export markets will outweigh the pandemic’s extraordinary stimulus.