ACE 2026 - The home of global charter.

The bimonthly news publication for aviation professionals.

The bimonthly news publication for aviation professionals.

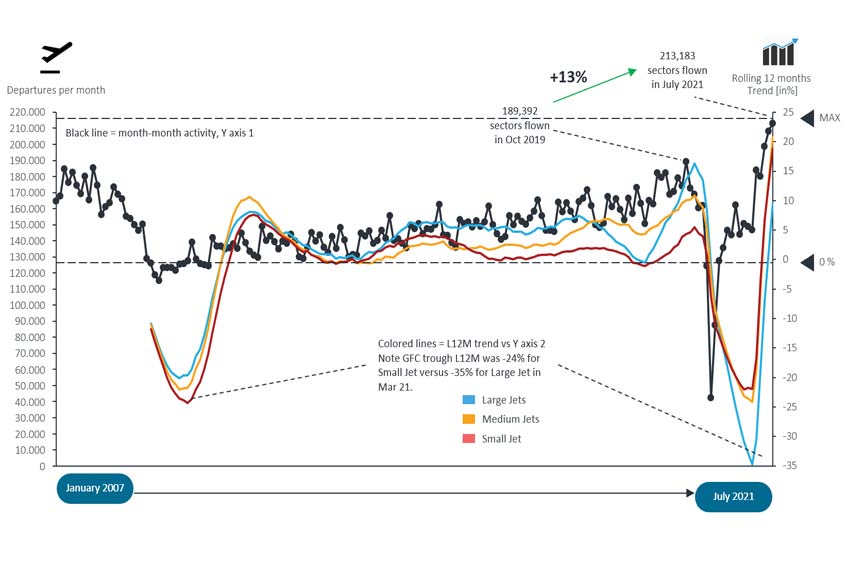

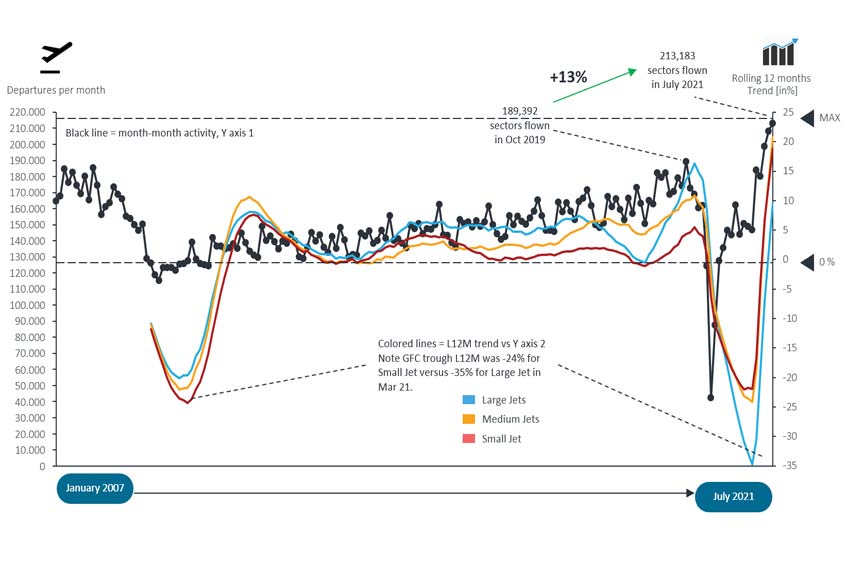

When the pandemic struck in early 2020, the resilience of business aviation activity in the first month was notable, as scheduled airlines quickly grounded their fleets. In contrast to the experience of the global financial crisis in 2008, when business aviation was first in and last out, analysts were quietly confident that demand would be first to recover after the pandemic. Sure enough, after a precipitous drop of 75 per cent in activity in April 2020, activity was back within 10 per cent of normal by mid-summer, and even surpassed pre-pandemic levels in Europe last August. Then came the winter wave, with travel restrictions setting the recovery back. But progressive lifting of lockdown restrictions, starting in Florida in early 2021, has catalysed a record-breaking recovery through this summer, according to WingX MD Richard Koe.

Ninety percent of business jet activity in North America comes out of the US, with this market the powerhouse of the recovery from the pandemic. Since May 2021, business jet flights out of the US have surged past comparative traffic levels two years before. July was the bumper month, with business aviation activity soaring 30 per cent above July 2019 and beating the busiest previous monthly record set in October 2019. The biggest rebound has come in Medium Jets, especially the Super Midsize platforms, but all cabin categories are seeing rolling 12-month growth of at least 10 per cent. The overall distribution of activity by cabin has resettled at pre-pandemic levels, with almost half the traffic small jet, 30 per cent medium, and the remaining 20 per cent of flying down to ultra long range jets and heavy jets.

Regionally, there has been a good deal of variation in recovery rates across the region. Business aviation traffic is still some way below normal in Mexico, and well back in Canada, where travel restrictions have persisted longest. The same applies to some Caribbean islands, notably the Caymans and Barbados. Other Caribbean destinations, including Turks & Caicos and Dominican Republic, have seen spectacularly high levels of bizjet traffic. The robust recovery in the US has been buoyed by rampant demand for business jet travel in and out of Florida, with getaway destinations, especially in Western States such as Colorado, Nevada, and Wyoming. It took until June for California to displace Florida as busiest State, and for Teterboro to reassert top position above Fort Lauderdale. Through the end of August, business jet flights are up 33 per cent compared to the same months in 2019.

“Business aviation has most obviously sprung back in the lighter aircraft fleets, with Cessna's business jet fleet seeing 11 per cent more activity this year than in 2019, Embraer jet sectors up by 16 per cent. Hawker Jet activity has beaten 2019 activity by nine per cent so far this year, even with a steadily diminishing fleet. Bombardier aircraft have been the most resilient large jets during the pandemic, mainly due to the versatility of the Challenger 300 platform. Gulfstream´s active fleet was slower to recover but after a hot summer, year-to-date trends are up 50 per cent on 2020 and three per cent on comparable 2019. Lear Jet and Dassault fleets haven't yet caught up with pre-pandemic. The most eye-catching growth has come from the relatively fast-selling light jet OEMs like Honda, Pilatus, and Cirrus. In the turboprop sectors, the PC-12 is easily the busiest aircraft this year, sectors up by two per cent on 2019.”

The recovery of business aviation demand in North America was unleashed by the lifting of the lockdowns but the underlying resilience showed up the importance of on-demand transportation as airline schedules shrivelled. At one point during last year, 33 per cent of all fixed wing activity in the US was business aviation. Unsurprisingly the best adapted operators have been the charter businesses. Branded charter operations, where floating fleets are dedicated to ad hoc or hourly charter demand, are seeing activity levels 10% higher than in year-to-date 2019, with 30 per cent growth in the last two months. Even with fierce price competition, this represents a record charter market. By contrast, Private and Corporate flight departments are still flying 10 per cent less than they were in 2019.

Koe adds; “The turbocharged charter business has clearly caught the eye of a much larger marketplace. Operators and brokers have consistently noted a large and sticky influx of first-time users this year. Operator consolidation was a trend pre-pandemic but it has clearly picked up in the last 18 months, with notable combinations including Wheels Up and Mountain Air, Vista Jet and Talon Air, Jet Linx and Meridian. Special Purpose Acquisition Companies have galvanised private investment into the industry, with Wheels Up backing into a SPAC to facilitate its IPO this summer, and Directional Capital, owning Flexjet and Sentient amongst others, launching a SPAC with a target value of $100M in new acquisitions.”

The investment pouring into the North American industry hasn't just been about operators, with two of the world's largest Private Equity companies competing for the two largest FBO chains, Signature and Atlantic Aviation. Anticipating the post-pandemic growth of business aviation, investors have noted the key importance of private jet terminal locations. The next generation of business jet services, which may branch to corporate shuttles, will bring increasing passenger flows through these terminals. The pandemic has jolted the development of eVTOL and associated Urban Air Mobility platforms, and leading business jet players clearly see an opportunity to get in at the ground floor. Directional-owned One Sky has recently grabbed the headlines with its order for Embraer's Eve vehicle.

The outlook for business aviation as we approach the last quarter of 2021 have arguably never been better. Resilience has turned to rebound as business jet demand has soared since the pandemic restrictions ended. Now the question is whether is whether we have seen a one-off bounce, or the signs of a sustainably bigger market. “Much of the recovery so far is discernibly leisure-driven, and that may reflect a temporary getaway impulse, which will taper as the pandemic ends,” Koe concludes. “Moreover, the corporate market may continue to work from home, even with restrictions lifted. On the other hand, the erosion in scheduled airlines, still 40 per cent less active this year than pre-pandemic, has left a substantial connectivity gap. As executives get back to work, fear of missing out on new deals should put them back in front of customers, with business aviation offering by far the most accessible solution.”