ACE 2026 - The home of global charter.

The bimonthly news publication for aviation professionals.

The bimonthly news publication for aviation professionals.

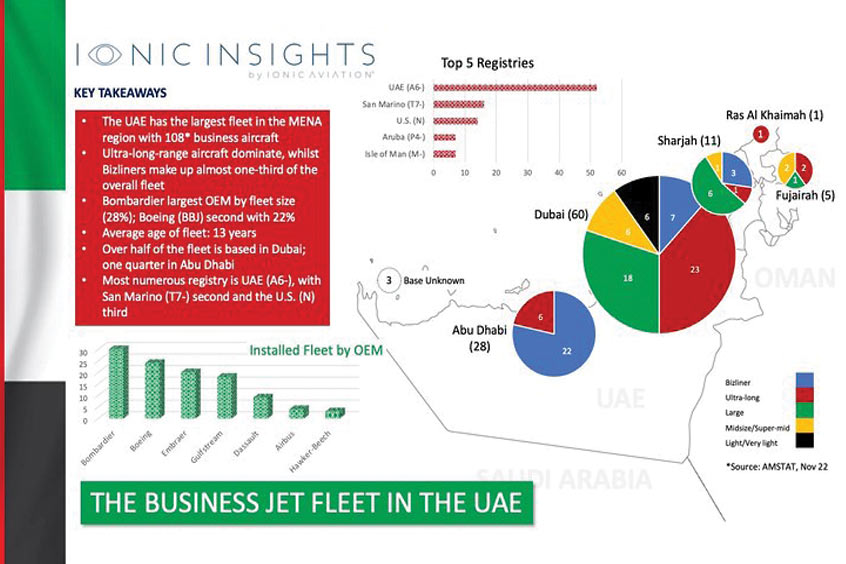

Ionic Aviation, the London-based corporate aircraft financial advisor, has produced a market commentary for the installed UAE business jet fleet to coincide with the MEBAA Show in Dubai. The report analyses the size, composition and age of the fleet while simultaneously investigating the most numerous aircraft registries, operators and base locations.

"The UAE has a population of a little over ten million but already boasts the region’s largest fleet of business aircraft," says managing director Graeme Shanks. "With a total of 108 jets, the fleet is now 25 per cent larger than that of its larger neighbour Saudi Arabia. Over half of all aircraft are based in the business, tourism and cultural hub of Dubai, while a quarter are based in the capital city of Abu Dhabi."

The dominant aircraft types are in the ‘heavy’ segment; these represent over two thirds of all aircraft.

While Bombardier is the largest OEM by fleet size, with 30 per cent of the fleet, it is notable that the Boeing Business Jet (BBJ) product line makes up over one fifth of all aircraft. This includes a total of 24 BBJ1, BBJ2, BBJ3, 747, 777 and 787 variants that are operated for the governments of Dubai and Abu Dhabi by Dubai Air Wing and Presidential Flight respectively, and by Royal Jet.

Unsurprisingly, light jets make up less than six per cent of the fleet. The largest owner-operator of light jets is Emirates Flight Training Academy in Dubai, with a total of five Embraer Phenom 100EV aircraft. Interestingly, the Cessna Citation product line does not currently feature.

Overall, the average age of the fleet is 13 years; a little under half of all aircraft are registered domestically, A6.

The financing of bizliners, particularly widebodies, for UHNW clients is most commonly driven by a handful of international private banks who do so on the basis of a client’s wider wealth relationship. That being said, asset and credit-based solutions exist for narrowbody variants such as BBJs, ACJs and the Embraer Lineage, albeit at more conservative advances and with faster amortisations than might otherwise be available for other new and pre-owned business aircraft.

"There are three key takeaways when comparing it to the EMEA more widely," says Shanks. "Firstly, the noticeably young average age of the fleet. Secondly, the proportion of aircraft at the larger, heavier end of the market, particularly corporate airliners that represent almost one third of the overall fleet. And thirdly, conversely, the very low number of light jet aircraft when they represent a far greater proportion of installed fleets across Europe as a whole."